Published in the Times of India Lucknow Edition (May 22, 2022)

The popular television series “Versailles”, which is streaming on Netflix, deals with the life of the Sun King Louis XIV and the intrigue of court politics during his reign. An interesting side subject which is touched upon, is the imposition of salt tax known as gabelle in French. The king increased the salt tax to account for the shortfall in revenue. Colbert, the finance minister, remonstrated, reminding the King that it was the tenth increase in so many years. Protests later erupt and eventually a revolution costs the later Louis XVI his crown and his life.

Salt is a curious commodity, ubiquitous and yet ever so precious. A simple compound made up of two elements Sodium and Chlorine in equal measure, it is a sine qua non for humans and has been used as a preservative since times immemorial. It dissolves in water easily, leaving no trace and while having the ability to corrode and destroy infinitely stronger compounds like metals. Both deficiency and excess consumption lead to life threatening conditions and along with sugar, its regulation is a subject of dinner conversations, medical conferences and food safety regulation standards.

While spices for flavour and preservation spurred Europeans to navigate oceans and “discover” new lands, the humble salt was also used to control trade and outcomes of wars. Often kingdoms such as in medieval Poland and cities across Europe rose and fell depending on the availability and ability to mine and sell salt. It was often a war strategy used to starve the enemy by denying access to salt and thus causing their food supplies to turn stale and foul.

Tax on salt has enriched and unsettled rulers. Russia had it and so did France as mentioned above. In India, the tax treatise Arthashastra written by Chanakya mentions a special officer designated to collect tax on salt. The Mughals also imposed salt tax in Bengal where it was mainly produced. Following the battle of Plassey, the British used to derive revenue from the land producing salt and also imposed duties on its transit. After the battle of Buxar, production and sale of salt was made the monopoly of the East India Company (apart from tobacco and betel nuts). At one point, salt contributed to around ten percent of the total revenue collected by the British ! Tax on salt was hated and much before the famous Dandi March by Gandhi ji, nationalists had advocated modifications and repeal of the salt tax. The first session of the Indian National Congress had it in their agenda, while Dadabhai Naroji gave an impassioned speech in the House of Commons against it. Gandhiji electrified the country with his famous March and was a contributing factor to eventual Independence. It was abolished, paradoxically, by Liaquat Ali Khan, the Finance Minister of the interim Government in 1946 (and later on Prime Minister of Pakistan). Curiously salt tax remained a cess (tax for a specific purpose) from 1953 for maintaining the salt production and distribution infrastructure until it was finally abolished in 2016.

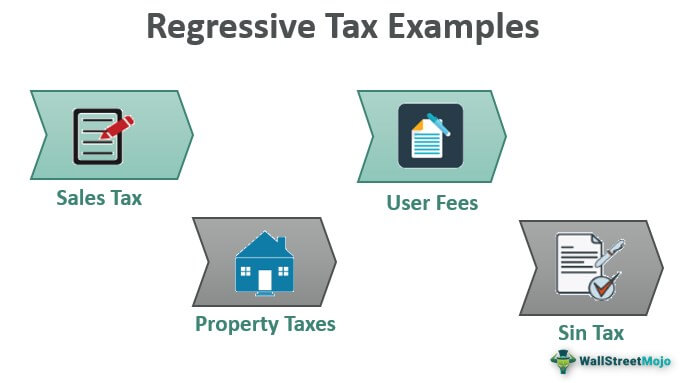

Why the fascination to monopolise and tax salt? Being a universal and indispensable ingredient, tax on salt ensured uniformity, uniformity and certainty in collection of revenue. Further it is a consumption tax wherein the tax is on consumption and included in the cost of the good. This is called sales tax, value added tax, goods and services tax etc. depending upon which country you reside in and the modality of levy. Indirect taxes have the benefit of inclusion within the price of a good or service and thus does not affect the individual directly. That’s why governments find it convenient to rely on indirect taxes as a source of revenue. The recent record monthly GST collections in India have shown the government’s intent to reap the benefits of GST reforms, better compliance and good enforcement by the officers administering Indirect taxes. However increased collections, while reflecting increased consumer demand and economic revival, also indicates rising inflation which is validated by wholesale and retail inflation statistics. Thus, indirect taxes adversely affect the consumer due to its inflationary pressure on price of goods and services. Further, indirect taxes are regressive, which means that they hurt the lower end of society much more than the upper echelons. Salt is a classic case, consumed by everyone in more or less the same quantities, but any tax on it will pinch the pocket of a less earning household more than anyone else. No wonder, revolutions have occurred on the issue of humble salt and increased taxes affecting the poor are currently causing economic and political upheavals in our neighbourhood.

So while indirect taxes are necessary for ensuring wide outreach as it is imposed on everyone, has certainty in collection as it is included in the price of commodity and also has a social objective to dissuade consumption of ‘sin’ products like alcohol and cigarettes; for developing economies, it is necessary to have a thrust on direct tax collections which are progressive, which means a person contributes according to his income levels and not his consumption pattern. This has the effect of reducing inequalities in society. Most developed nations have collections from direct taxes exceeding indirect taxes while ironically developing countries which need to reduce inequality in society still rely more on indirect taxes.

The recent direct tax reforms in India, have signaled the Government’s intent in making direct tax administration more transparent with the help of technology and reducing physical interface. Better enforcement based on modern data analytics and pinpoint intelligence apart from inter-agency coordination will help to widen and deepen the tax base. Incentivising compliant taxpayers through cashbacks and loyalty points will help to improve engagement with taxpayers who may like to see “tax” as their contribution to the nation and society be it for maintaining our armed forces or enjoying subsidised public goods and services e.g., free COVID-19 vaccines at government hospitals. However, the government may also like to focus on the expenditure side of the ledger account to ensure that each rupee collected from a taxpayer is made to count.

Thus, while we may and should rejoice at improved GST collections, improved “contributions” through direct collections will help to generate revenue needed for growth and development. This will require renewed focus on direct taxation with meaningful patriotism conveyed through true disclosures and contribution. Meanwhile enjoy your salt, but do not rely too much on it!

Leave a comment